Contents:

The purpose of margins is “to determine the value of incremental sales, and to guide pricing and promotion decision.” You need to provide the two inputs of gross profit and revenue. From the above calculation for the gross margin, we can say that the gross margin of Honey Chocolate Ltd. is 30% for the year.

Use the formula above to include gross profit math so you can see both. It’s a variable cost because you would not have that, but it’s not direct. Sales is a cost to generate a customer who will then generate revenue from somebody else. Variable costs increase and decrease depending on the volume of goods or services produced. Using this equation, you can create a Contribution Margin Income Statement, which reverses the order of subtracting fixed and variable costs to clearly list the contribution margin.

- These methods produce different percentages, yet both percentages are valid descriptions of the profit.

- A business can be or maybe more efficient at producing and selling one product than another.

- The GPM is used to measure how efficiently a company is able to turn its sales into profits.

- Indirect CostsIndirect cost is the cost that cannot be directly attributed to the production.

Lately, she has been thinking of expanding her line of clothing, too. Profit margins for a startup are generally lower because the operation is brand new, and it typically takes a while for efficiencies to develop. To interpret this percentage, we need to look at other similar companies in the same industry.

The cost of goods sold is the direct labor and material costs for creating products. Then, you can easily calculate the gross margin in the template provided. DepreciationDepreciation is a systematic allocation method used to account for the costs of any physical or tangible asset throughout its useful life.

How to calculate gross profit margin for a service business

In order to express the metric in percentage form, the resulting decimal value figure must be multiplied by 100. More detailed definitions can be found in accounting textbooks or from an accounting professional. Xero does not provide accounting, tax, business or legal advice. Hearst Newspapers participates in various affiliate marketing programs, which means we may get paid commissions on editorially chosen products purchased through our links to retailer sites. The second way of retailers can be achieve at a high ratio is by just marking their goods up by higher.

So, the net profit would be how much is left over after all of that is covered. To find the net profit margin, you divide the net income by total revenue, creating a ratio. Gross profit margin is a vital health metric because it keeps the focus on growing profits, not just revenue. It immediately provides context because it shows the percentage of profit, unlike gross profit, which shows an absolute profit value without the comparison to total revenue. With a selling price of $100 and a cost of $75, the $25 markup as a percentage of the $75 cost is 33.33% ($25/$75). The gross profit of $25 ($100 – $75) also means a gross margin of 25% ($25 gross profit divided by the selling price of $100).

Before you start to calculate gross margin, know that margins vary significantly from industry to industry. Grocery stores have very low margins, whileSaaS subscriptionservices have much higher margins. That’s why to calculate gross margin, analysts often use the percentage formula to compare margins within and across industries. Both gross margin formulas are used depending on what metrics are being evaluated.

Gross Profit Margin Ratio Analysis Definition

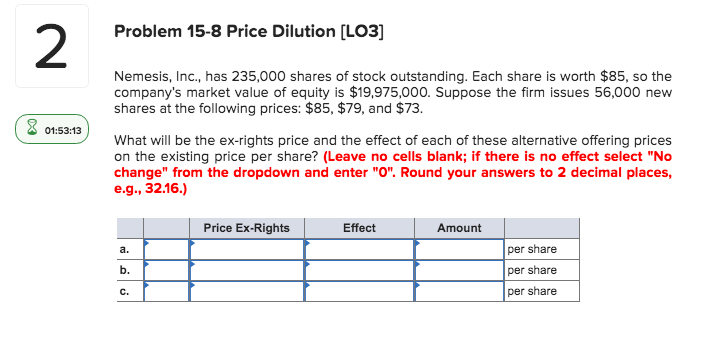

Joe thinks he may be able to cut back on raw materials by changing his construction process. Essentially, he is wondering what is his gross profit margin rate is. Once the proper numbers are found uses the gross profit margin ratio calculator on his Texas Instruments BA II. His results are shown below. This shows that the company’s gross margin ratio is 0.75 or 75%. In other words, each product the company makes generates a revenue of $0.75 from every dollar.

However, this store can be a prime tourist location, and charges can be applied as a heavy premium for the company’s clothing. Those high prices can also directly affect the company’s gross profit margin. Like any other financial ratio, the gross profit margin can be only meaningful on a comparative basis. The financial manager might want to use trending analysis for comparing the gross profit margin to other periods or industry analysis compared to other similar companies.

Secret to improve Gross margin ratio

The https://1investing.in/ profit margin percentage is one of the key aspects that I need help with. That’s because the gross profit margin doesn’t account for important financial considerations like administration and personnel costs. If not managed properly, these indirect costs can really eat into a company’s profit.

2023-2029 Stroke Post Processing Software Market Size Detailed … – Digital Journal

2023-2029 Stroke Post Processing Software Market Size Detailed ….

Posted: Thu, 13 Apr 2023 06:45:48 GMT [source]

Gross profit is revenue minus the direct cost of goods or services. For example, if a company sells T-shirts, its gross profit would be how much it made from selling the shirts minus how much the company paid for the shirts. The margin is the gross profit divided by the total revenue, which creates a ratio. You’ll use the same basic formula to find the gross profit margin for a single product or for the entire company. Keep in mind that you can’t find the average gross profit margin for your company by combining product GPMs. You’ll need to recalculate by using the total revenue and COGS for the company.

How do you calculate the gross profit margin percentage?

Gross margin percentage is a percentage calculated by subtracting cost of goods sold from revenue and dividing that number by revenue and multiplying the result by 100. The latter amounts to 13,541 since other items are not included in variable costs. As soon as you make several calculations, you are able to compare your GPM with the average value in your industry and understand the current position of your business. In fact, this metric indicates the financial success and expediency of any service or product. Any entrepreneur should strive for higher value, since it shows how much the company retains on each dollar of service sale. The formula is simple, but what these expenses might include is not clear.

Even bankers may use profit margins to determine if a company is profitable and worth the investment. In accounting, the gross margin refers to sales minus cost of goods sold. It is not necessarily profit as other expenses such as sales, administrative, and financial costs must be deducted. And it means companies are reducing their cost of production or passing their cost to customers. The higher the ratio, all other things being equal, the better for the retailer. Higher gross margins for a manufacturer indicate greater efficiency in turning raw materials into income.

Resources for YourGrowing Business

If markup is 30%, the percentage of daily sales that are profit will not be the same percentage. A company’s real profits can only be calculated once all costs are subtracted. These may include costs such as advertising, interest, taxes, labor, material, and overhead costs. Why do some businesses manufacture products when service-based businesses enjoy more profits? Well, if the business is large enough, it can benefit from economies of scale, a phenomenon where the average cost of goods sold decreases with an increase in output. He has no cost of goods sold because he’s not selling a product.

- Overall, the GPMP is a good indicator of the company’s financial health.

- You’ll need to recalculate by using the total revenue and COGS for the company.

- For every dollar in sales, the coffee shop has 40 cents in gross profit that it can use to pay for other business expenses .

- However, this has to be done carefully, as the company/ business might lose customers if the prices are too high.

- Tina’s T-Shirts is a small business that has been open for about a year.

- Using this equation, you can create a Contribution Margin Income Statement, which reverses the order of subtracting fixed and variable costs to clearly list the contribution margin.

This means that for every present value formula generated, $0.3826 would go into the cost of goods sold, while the remaining $0.6174 could be used to pay back expenses, taxes, etc. Unfortunately, this strategy may backfire if customers become deterred by the higher price tag, in which case, XYZ loses both gross margin and market share. Any successful revenue management strategy requires the right market intelligence.

Use this figure to decide whether you need to make changes to pricing or to the production process. GPM can also help you decide where to invest your marketing spend. For example, say you are running a special promotion to increase product purchases.

The tools and resources you need to take your business to the next level. The tools and resources you need to run your business successfully. The tools and resources you need to get your new business idea off the ground. Multimedia Hub Browse podcasts, videos, data, interactive resources, and free tools.

2023-2029 Airport Retail Market Size Detailed Report with … – Digital Journal

2023-2029 Airport Retail Market Size Detailed Report with ….

Posted: Thu, 13 Apr 2023 06:45:48 GMT [source]

Profitability is an important factor to consider for investors. Investors look at mainly net profit margin along with gross margin. The gross profit margin calculator is useful to investors because they can easily compare it with other similar companies by calculating the percentage. The main constituents of the gross margin ratio are the operating revenue and expenses.